Are you finding it almost impossible to get ahead of your debt? If so, you are not alone. Long-standing debt affects a large portion of the U.S. population due to unexpected expenses, high interest rates, poor investments, sudden changes in personal circumstances, and other common factors. In some cases, borrowers sink further into debt every month due to an inability to fulfill minimum payments with their current income. It is for this reason that debt relief resources are available from non-profit organizations throughout the United States. When interest rates and credit balances far exceed an individual’s earning potential, it may become more beneficial for creditors to negotiate debt relief than to continue charging fees.

While debt relief may seem like an attractive option for borrowers, many Americans are unclear on what exactly these programs entail, whether or not they are eligible to enrol, what they should watch out for, and other important details. These specifics differ between debt relief companies, which is why it is crucial to work with a reputable organization.

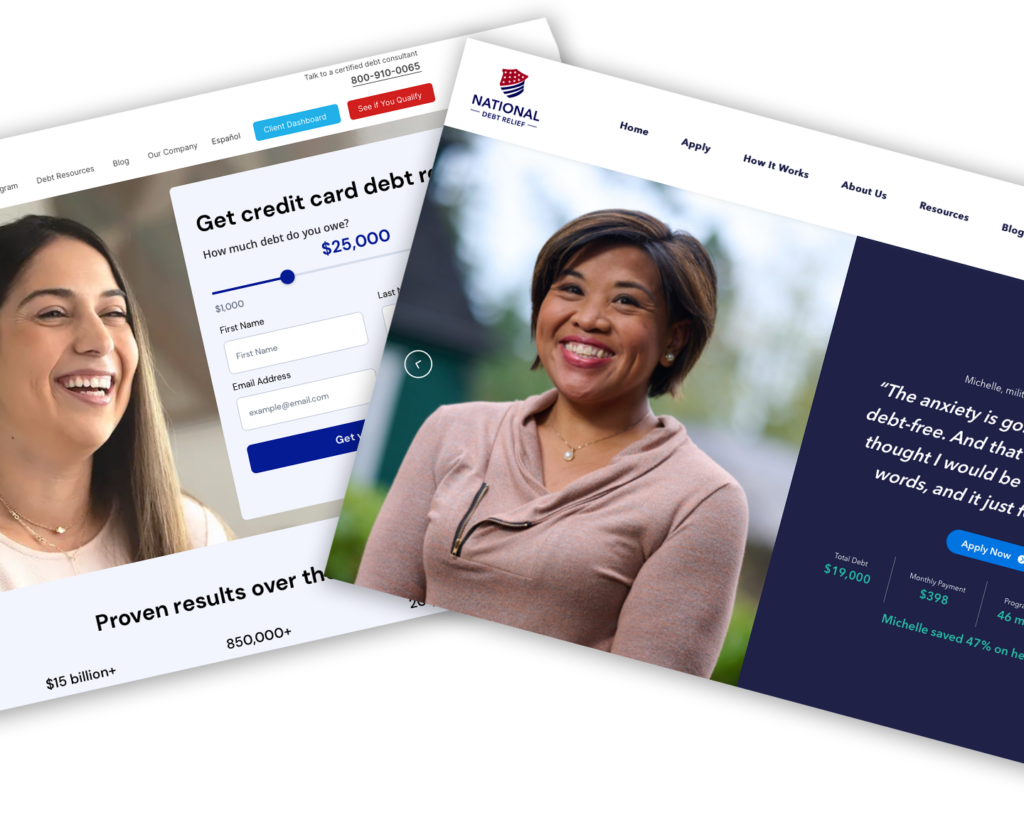

In the United States, Freedom Debt Relief and National Debt Relief are by far the two most trusted businesses for this type of financial assistance. Below we have provided a detailed analysis of these two organizations.

Freedom Debt Relief vs. National Debt Relief

Freedom Debt Relief vs. National Debt Relief: How Do They Work?

Freedom Debt Relief and National Debt Relief offer programs that are structured using nearly identical methods. Learning how exactly these organizations work is important to understanding whether or not a debt relief program is suitable for you.

The first thing that borrowers should understand about these programs is how exactly they can reduce debt. Both organizations start by conducting a thorough assessment of the client’s financial situation including their total debts, interest rates, expenses, and income. By understanding the individual’s circumstances, certified specialists can then leverage this information to negotiate with creditors. During negotiations, a representative from your organization of choice will request a reduction on your behalf, of the total amount of debt owing.

It may seem counterintuitive for a lender to agree to a debt relief program when they are collecting interest every month, however, there are several reasons why a creditor may accept a proposal of this kind. If a borrower is accumulating more debt every month, they are at a high risk of filing for bankruptcy. This can result in major financial losses for lenders, making them more likely to agree to a reduction in debt.

Once a debt relief proposal has been accepted, the client stops making payments directly to their lender and instead, pays into an FDIC-insured savings account. Once the agreed upon amount is paid in full, the creditor will receive the lump sum. In return for these services, both National Debt Relief and Freedom Debt Relief charge a 15-25% fee on the client’s total debt.

Debt relief programs are relevant to those who are in severe debt with unsecured loans. Unfortunately, secured loans such as mortgages and certain types of business loans may not be negotiated due to collateral.

Freedom Debt Relief vs. National Debt Relief: How Do You Get Started?

To get started with one of these organizations, the first step is to ensure you are eligible to participate in a debt relief program. Both Freedom Debt Relief and National Debt Relief require a minimum of $7500 debt for clients to be considered eligible. As previously mentioned, the debt that you are interested in settling should come from unsecured loans such as credit cards or student loans. Finally, it is important to realistically consider your ability to meet debt obligations. In other words, if your inability to repay debt could be resolved by a few simple lifestyle changes, you are likely not eligible for debt relief. If however, your circumstances render you entirely incapable of overcoming debt, you are likely a suitable candidate.

Once you have determined your eligibility, the next step is to contact a professional from one of these organizations. They will be able to confirm your eligibility during a free initial consultation, and subsequently begin reaching out to your creditors.

Freedom Debt Relief vs. National Debt Relief: Key Differences

When comparing National Debt Relief vs. Freedom Debt Relief, it is useful to know even the smallest differences between these organizations. These companies operate in an almost identical way in terms of eligibility requirements, program duration, fees, and other key areas. However, there are several details that may make one organization more suitable than the other depending on the client.

First, Freedom Debt Relief is a slightly more established organization, celebrating over 20 years in business. Freedom Debt Relief was founded in 2002, with National Debt Relief following seven years later in 2009. Although both of these organizations are considered industry leaders, the former offers slightly more experience than the latter.

Another key difference between these two organizations is their service areas. While both programs are widely available throughout the United States, neither operates in all 50 states. Rather, National Debt Relief serves 42 states with Freedom Debt Relief falling slightly behind at 38 states.

Finally, both organizations structure their fees using a sliding scale method of 15-25%. However, this can cause slight differences between individual quotes. This is dependent on how each organization interprets and evaluates the client’s specific financial circumstances. For this reason, it is useful to request an initial consultation with both of these organizations before enrolling in a debt relief program.

Freedom Debt Relief vs. National Debt Relief: Why Use a Debt Relief Organization?

There are many reasons to work with a debt relief organization instead of carrying on with your loan repayments. Perhaps the most obvious reason is to reduce your overall financial burden. If you are in a position where your debt is growing every month due to high minimum payments and interest rates, a debt relief organization can help you overcome this debt in less than four years.

Another reason to use a debt relief organization is to improve your credit score long-term. This may seem counterintuitive, as these programs are likely to negatively impact your credit score. However, accepting an immediate reduction in credit score may be the better option as opposed to slowly worsening your score each year as you sink further into debt and are unable to make minimum payments. The main goal of debt relief organizations is to allow those in extreme debt to start over.

Are you finding your debt to be no longer manageable? Contact us today to learn more about Freedom Debt Relief vs. National Debt Relief and determine which organization is right for you.